when are property taxes due in will county illinois

Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle. The property tax rate in Will County Illinois is 205 costing residents an.

North Central Illinois Economic Development Corporation Property Taxes

205 of home value.

. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. Mail your payment to. State of Illinois.

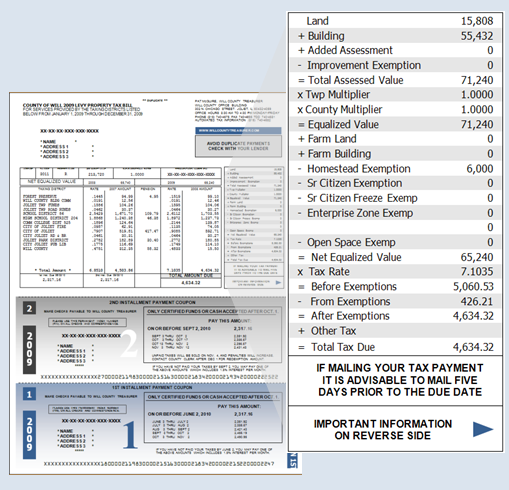

In most counties property taxes are paid in two installments usually June 1 and September 1. Apply For Tax Forgiveness and get help through the process. 101 South Main Street.

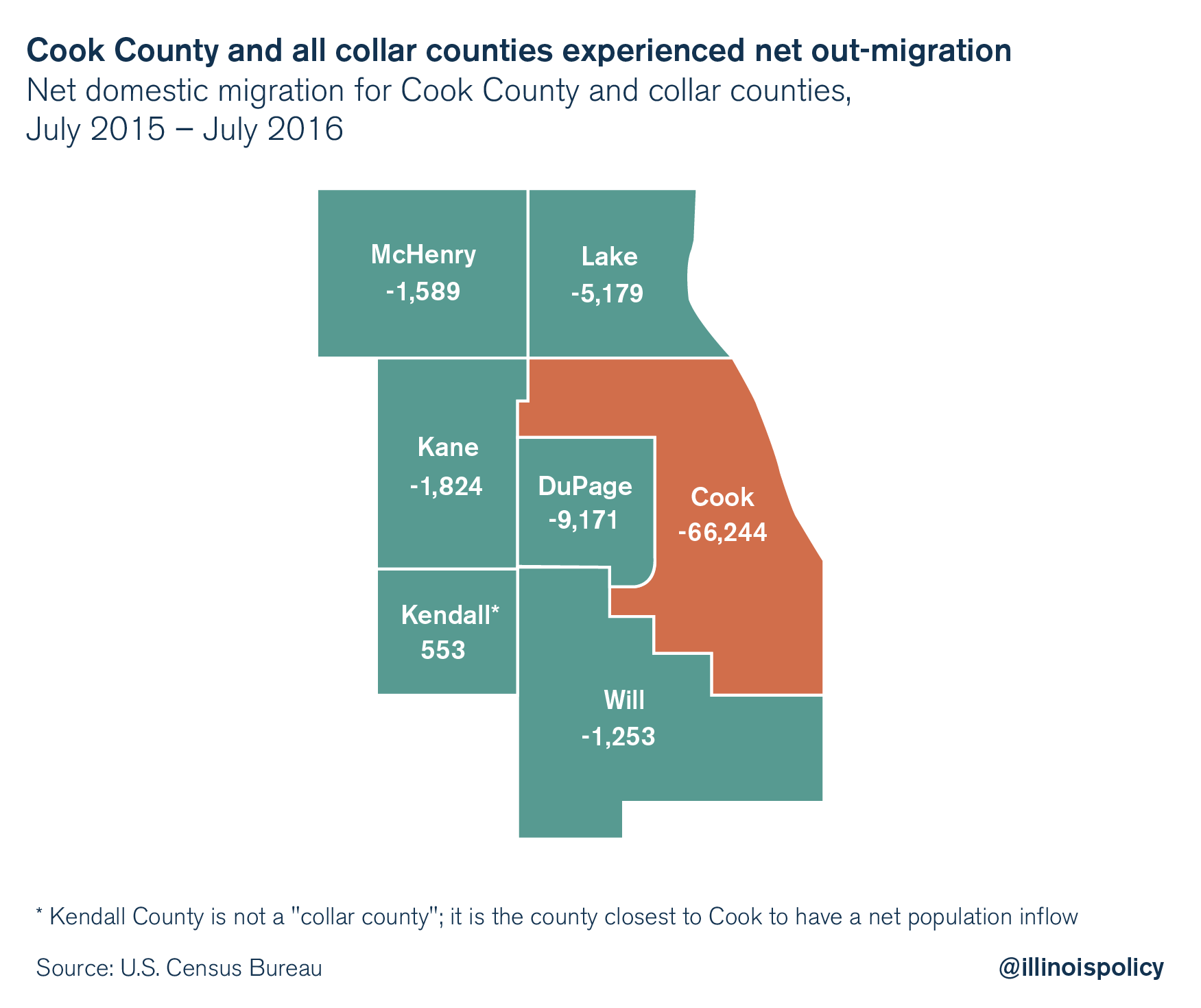

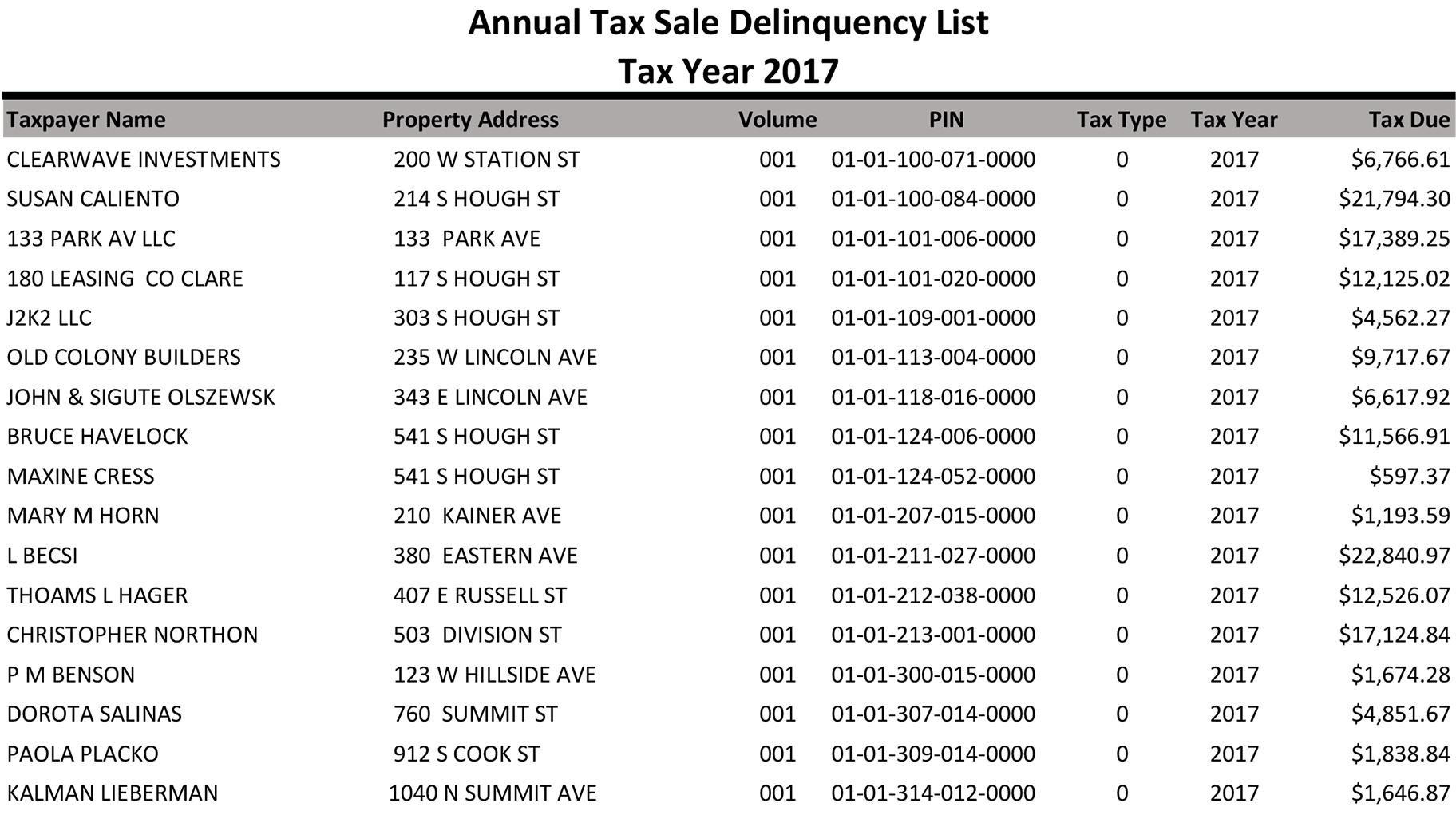

407 N Monroe Marion IL 62959 Phone. 1 day agoThe Cook County tax sale begins next week on November 15. Tax Year 2021 Second Installment Property Tax Due Date.

Illinois Property Taxes Go To Different State 350700 Avg. Tim Brophy WILL COUNTY TREASURER On November 10 2022 the GovTech online payment. Reduce property taxes for yourself or residential commercial businesses for commissions.

The county said second installment bills will come before the end of the year. Welcome to Property Taxes and Fees. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Are Illinois property taxes extended. The first installment of property tax bills in 2023 is expected to be due March 1. A monthslong delay in the mailing of Cook County property tax bills has been resolved.

173 of home value Tax amount. Clicking on the links with this symbol will take you to a county office or related office with its own website. PROPERTY TAX APPEAL BOARD.

Chicago Street Joliet IL 60432 815-740-4675 Subsequent taxes will only be accepted in. Will County Illinois Property Tax Go To Different County 492100 Avg. State law allows tax rates up to 015 of equalized assessed value but boards.

Cook County voters approve property tax increase for the forest preserves. 100s of Top Rated Local Professionals Waiting to Help You Today. Will County Treasurer 302 N.

In Will County property taxes are due on June 1st and September 1st of each. For now the September 1 deadline for the.

Reboot Illinois Which Illinois Counties Have The Highest Average Home Prices And Property Taxes Property Tax County House Prices

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Analysis New Lenox Pays Property Taxes Two Times National Average Will County Gazette

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

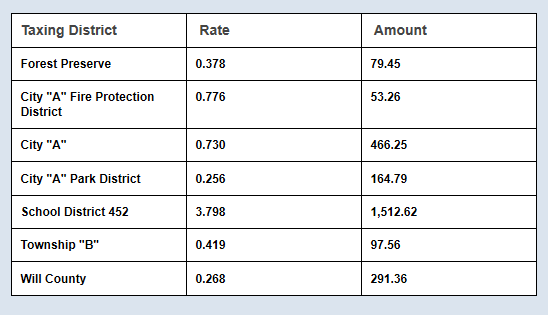

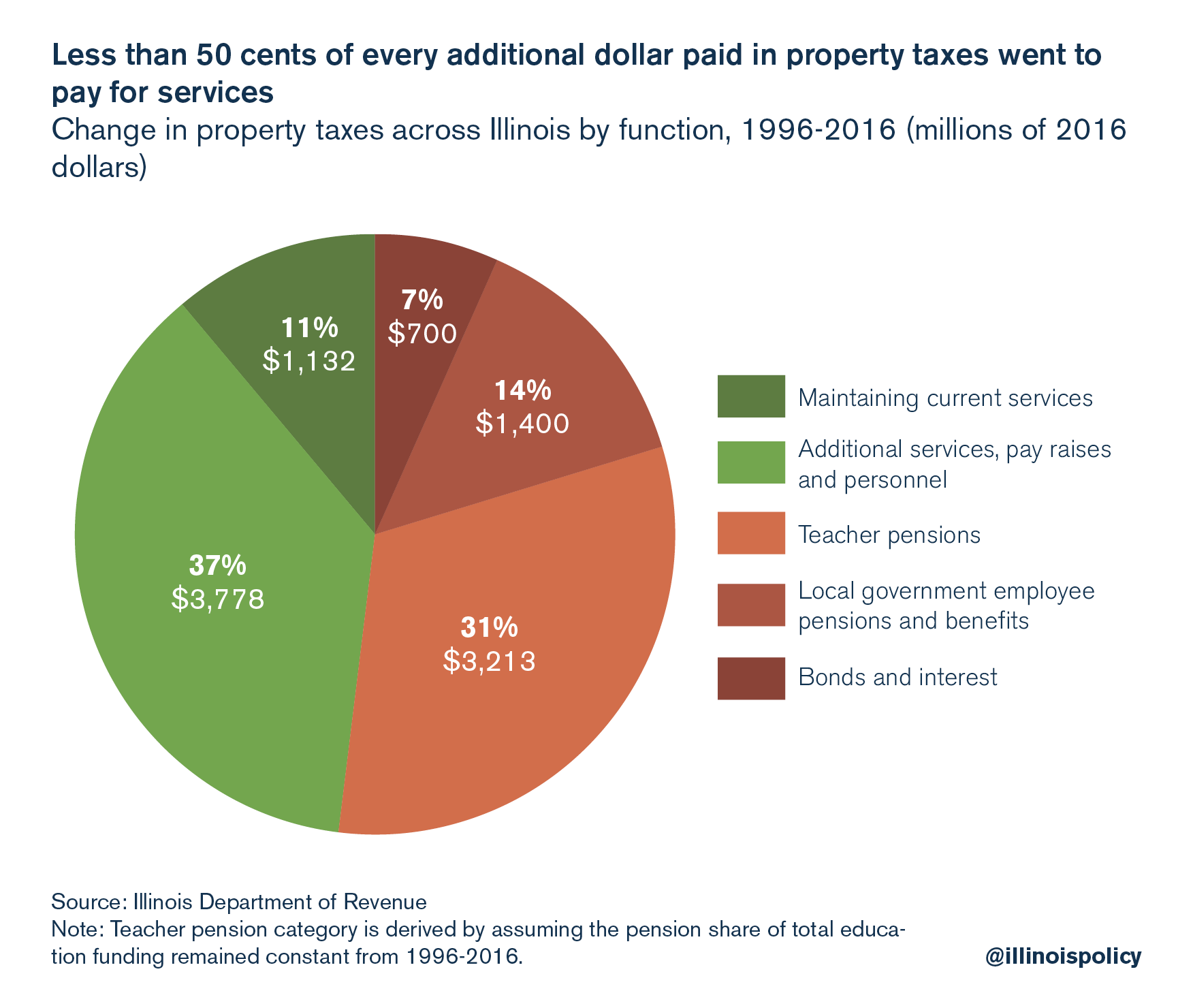

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Late Property Tax Bills In Cook Co Still Not Ready

Analysis Willowbrook Pays Property Taxes Nearly Three Times National Average Will County Gazette

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

150 Lockport Il Ideas Lockport Lockport Illinois Illinois

Illinois Property Tax Calculator Smartasset

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

Delinquent Tax Deadline Looms For 45k Property Owners In Cook County Chicago News Wttw