flow through entity example

Any payments toward a flow-through entitys 2021 calendar tax year that are made after March 15 2022 will be claimed as a credit against members 2022 tax liability. Any flow-through entity taxes paid are passed proportionally up to the ultimate owners as an upper tier flow-through entity cannot apply a flow-through entity tax credit.

Ch2 Solutions Q A 2 Chapter 2 Corporations Introduction And Operating Rules Solutions To Studocu

Lastly this update clarifies in Section.

. Flow-Through Entity Definition Meaning Example Business Terms Income Tax Taxes. There are three main types of flow-through entities. Examples of Flow Through Entity in a sentence.

The example was further revised to use the appropriate tax base starting point Business I ncome rather than Federal Taxable Income. 3 Go to your custom flow paste Relationship Entity Name in the entity. Explore more on it.

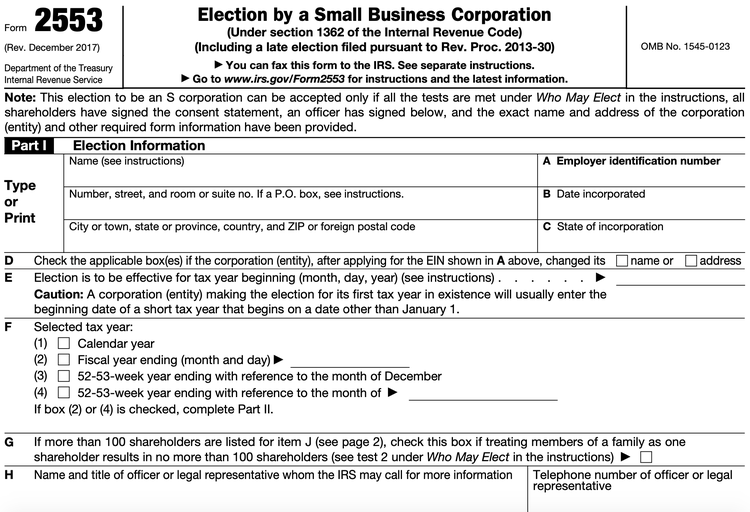

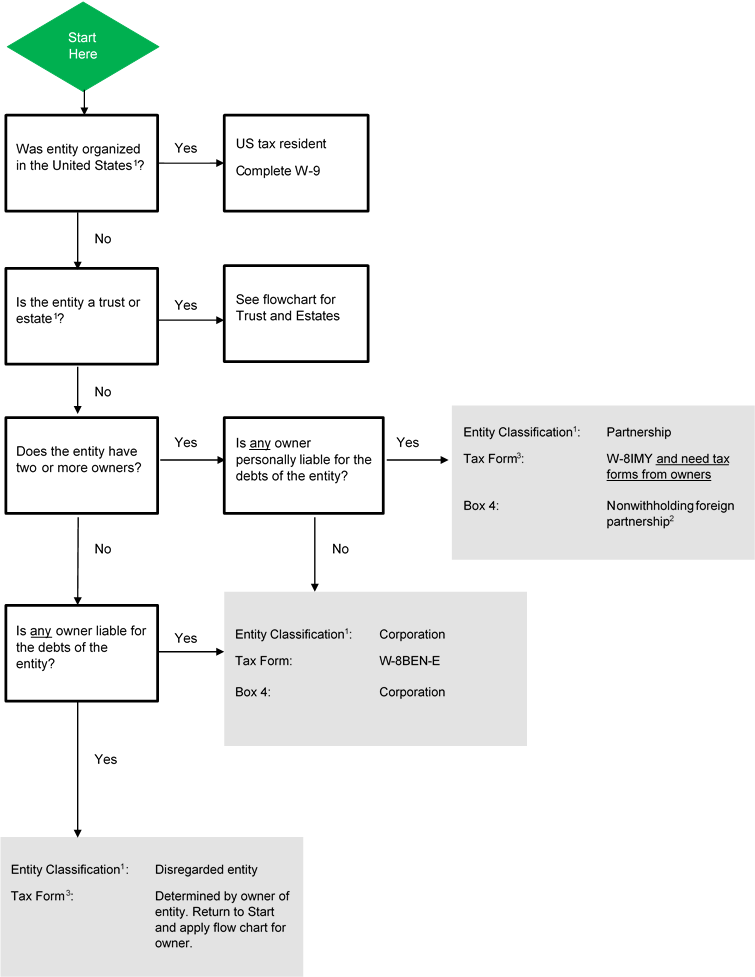

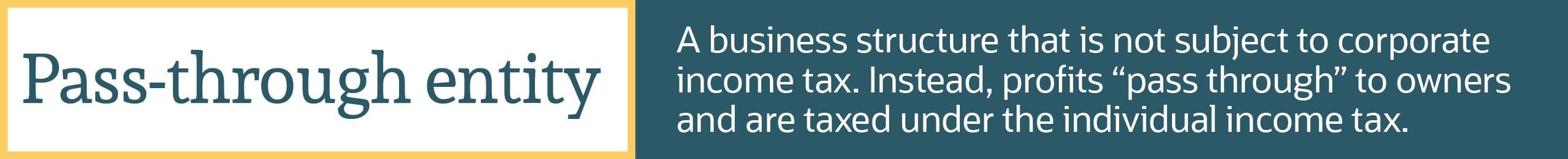

Under 114461 of the proposed regulations a partnership generally determines the status of its partners based upon Form W8BEN. A flow-through entity FTE is a legal entity where income flows through to investors or owners. A business owned and operated by a single individual.

Consequently what is a flow through entity for tax purposes. What is a flow through entity example. Although this flow-through entitys members may report their.

A flow-through entity is a legal business entity that passes income on to the owners andor investors of the. Everything you need to know about Flow-Through Entity from The Online. Explore more on it.

The model rules refer to flow-through entities. Excluding sole proprietorships which receive just 4. That is the income of the entity is treated as the income of the investors or owners.

Examples of Flow Through Entity in a sentence. A hybrid entity for this purpose is an entity that two contracting States that are parties to a bilateral tax treaty characterize differently eg. For example- new_account_target to new_account_targetset.

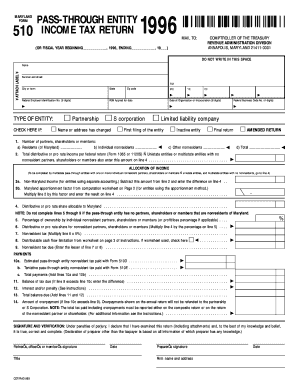

PASS-THROUGH ENTITY TAX. An entity is considered a flow-through entity if it is treated as tax transparent in the jurisdiction it was created which we understand to mean. Under 114461 of the proposed regulations a partnership generally determines the status of its partners based upon Form W8BEN.

This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the. A flow-through entity is a legal business entity that passes income on to the owners andor investors of the. Consequently what is a flow through entity for tax purposes.

The share of business activity represented by flow-through entities has been rising since the passage of the Tax Reform Act of 1986. An entity such as a limited liability company. For example a flow-through entity that elects into tax year 2021 on March 31 2022 pays all tax due for the year on that date.

People also ask what is a flow through entity. A better example is where a company is 51 black owned and it owns 51 of the entity. Types of flow-through entities.

Pass Through Business Definition Taxedu Tax Foundation

An Overview Of Pass Through Businesses In The United States Tax Foundation

Tax Effecting And The Valuation Of Pass Through Entities The Cpa Journal

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Fillable Online Maryland Part Year Resident Pass Through Entity Form Fax Email Print Pdffiller

A Beginner S Guide To Pass Through Entities

Entity And Fatca Classification For Non Financial Entities Ib Knowledge Base

Understanding Flow Through Entities Like S Corporations And Llc S Pace Accounting

Sole Proprietorships And Flow Through Entities Ppt Download

How To Choose Your Llc Tax Status Truic

More Reporting Possible For Disregarded Entities

Pass Through Entity Tax 101 Baker Tilly

Publicly Traded Partnerships Tax Treatment Of Investors

Flow Through Entities Income Taxes 2018 2019 Youtube

Pass Through Entity Tax Annual Filing Demonstration Youtube

The Qbi Deduction Do You Qualify And Should You Take It Bench Accounting

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

4 Types Of Business Structures And Their Tax Implications Netsuite

:max_bytes(150000):strip_icc()/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)